AFFORDABLE BUSINESS ACCOUNT

FIRST BUSINESS ACCOUNT WITH ZERO MONTHLY FEE

First Business Zero is more

than just a bank account

Financial services group FNB has launched a bank account for small business owners, with no monthly fee.

“First Business Zero has been designed specifically for sole proprietor businesses with an annual turnover up to R5 million and can be opened on the FNB App using our ‘selfie’ process to identity and verify the user,” said Mike Vacy-Lyle, FNB Business chief executive officer.

At an event in Bryanston on Tuesday (15 October), FNB said that its new account offering includes 30 minutes of free calls per month, along with 30 free SMSes, and 100 MB of data. Account holders will also have access to unlimited free card swipes.

Features:

- No monthly account fee;

- Unlimited free point-of-sale card swipes;

- Inter-operable QR code;

- Linked saving pocket;

- An FNB Connect SIM card.

It will also provide support for small businesses and entrepreneurs, around accounting practices and other financial related activities. Businesses will get free access to FNB Business’ unique suite of free value-added services, including Instant Accounting software, Invoicing, Cash Flow and Payroll.

A digital business bank account will be available from 1 November, FNB said.

South Africa has seen the launch of several new entrants into the banking space in the past few months including digital only TymeBank, and Discovery Bank, while Michael Jordaan’s Bank Zero is expected to launch in 2020.

TymeBank’s success has been immediate, having recorded significant uptake since its official launch at the end of February 2019.

Tauriq Keraan, chief executive officer at TymeBank, told delegates at the BusinessTech FinTech conference in September, that the bank has 735,000 customers and 325,000 active customers as of September 2019 – a significant jump from the 500,000 customers in July.

Discovery Bank meanwhile, the consumer offering from the country’s largest medical aid provider, Discovery, claims to be the world’s first behavioural bank that is designed to help improve your financial health and reward you for banking healthier, like its Vitality offering.

“We actually welcome competition, it will make banking more affordable. As a bank we see ourselves as fintechs. Our customers expect a digital experience. Banks have a duty to digitise, to be fintechs,” Vacy-Lyle said.

He stressed that the bank continues to open new branches, rather than close them as has been reported in the media. He pointed out that FNB has opened as many as seven new branches in the past several months alone.

The bank has pledged to become more relevant in the country’s township and rural economy, to continue to spur and support entrepreneurial growth.

In July, FNB launched a free health rewards programme – ‘nav» Wellness’ – within its banking app that offers discounts at spas, gyms, healthy food delivery services and genetic testing.

“FNB has invested billions of rands in developing a business banking platform that offers holistic and integrated financial solutions to all types of businesses. To maintain our market leading position, it is essential that our business model continually evolves to provide relevant solutions for customers, from learning how to start, run and grow a business, to registering a company, opening a bank account, applying for credit and managing the businesses daily affairs,” said Vacy-Lyle.

“Better use of data, understanding client context, easier credit applications through scoring and digitisation, as well as lower origination costs, have led to better, deeper credit underwriting and quicker turnaround times. This has made borrowing from FNB Business a much better experience with better pricing,” added Vacy-Lyle.

Fundaba

FNB is also launching a new digital app-based entrepreneurship learning programme called Fundaba.

Fundaba is free interactive e-learning business education platform that has been developed inside the FNB banking app. “It is a first-of-its-kind offering in South Africa and comprises multimedia content such as videos, podcasts, quizzes, templates and tools for all FNB customers to learn about entrepreneurship and running a business,” the bank said.

“As a leading business bank in South Africa, a core part of our strategy is to help develop SMEs by supporting entrepreneurs through their journey, and a key part of this journey is entrepreneurship knowledge and skills which we believe can help on a large-scale using our digital infrastructure” said Jesse Weinberg, head of the SME Customer Segment at FNB.

“This is partly the reason debit orders are not allowed on the digital account as customers in this segment have limited debit orders.”

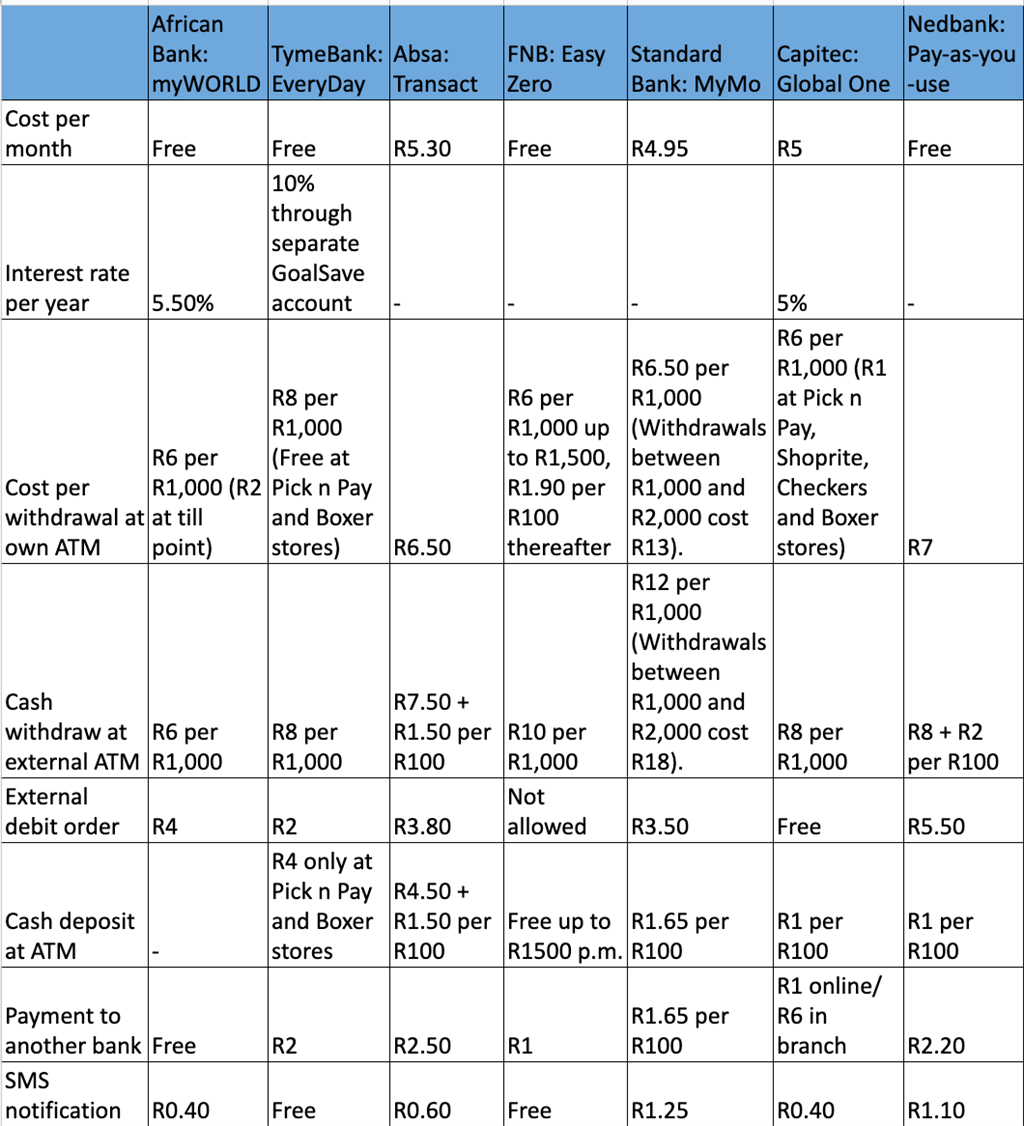

Business Insider South Africa compared FNB’s Easy Zero offering with existing entry-level accounts South African banks.

The bank account joins African Bank’s myWORLD and TymeBank’s EveryDay as zero monthly fee bank accounts in South Africa.